The Advantages of Embedded Payment Solutions for Software Companies

The Advantages of Embedded Payment Solutions for Software Companies

What are Embedded Payment Solutions?

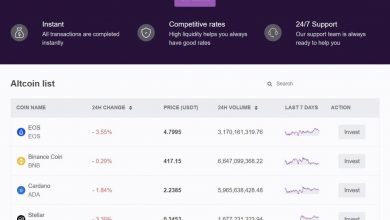

Embedded payment solutions are integrated payment processing tools that software companies can incorporate into their applications or platforms. These solutions allow software companies to seamlessly accept payments from their users without redirecting them to external websites or relying on third-party payment gateways.

The Benefits of Embedded Payment Solutions for Software Companies

Enhanced User Experience

One of the key advantages of embedded payment solutions is that they offer a seamless and cohesive user experience. Instead of redirecting users to external payment gateways, embedded solutions keep them within the software application, allowing for a more seamless payment process. This enhances user satisfaction and reduces the likelihood of abandoned transactions.

Increased Revenue Generation

By incorporating embedded payment solutions, software companies can provide their users with a more convenient and frictionless payment experience. This, in turn, can lead to higher conversion rates and increased revenue generation. When the payment process is simple, secure, and integrated within the software, users are more likely to complete their transactions.

Reduced Development Time and Effort

Implementing a custom payment system from scratch can be time-consuming and resource-intensive for software companies. Embedded payment solutions offer pre-built integrations that can be easily incorporated into software applications, eliminating the need for extensive development work. This saves both time and effort, allowing software companies to focus on their core product development.

In-Depth Analytics and Reporting

Embedded payment solutions often come with robust analytics and reporting features. Software companies can gain valuable insights into their payment processes, including transaction volumes, customer behavior, and revenue trends. This information can help businesses make data-driven decisions, optimize pricing strategies, and improve overall performance.

FAQs about Embedded Payment Solutions for Software Companies

Q: How secure are embedded payment solutions for software companies?

Embedded payment solutions prioritize security and compliance. They adhere to industry standards and employ various encryption techniques to protect sensitive data. Additionally, they undergo regular security audits to ensure that transactions are secure and private.

Q: Can software companies customize the payment experience with embedded solutions?

Yes, most embedded payment solutions offer extensive customization options. From branding and user interface to the checkout process, software companies can tailor the payment experience to align with their brand identity and provide a seamless transition for their users.

Q: Are embedded payment solutions scalable?

Absolutely! Embedded payment solutions are built to scale alongside software companies as their user base grows. These solutions are designed to handle high transaction volumes without sacrificing performance or security. Additionally, they often offer features like recurring billing and subscription management, making them ideal for SaaS businesses.

In conclusion, embedded payment solutions offer numerous advantages for software companies. They enhance the user experience, increase revenue generation, reduce development time, and provide valuable analytics and reporting capabilities. By choosing an embedded payment solution, software companies can streamline their payment processes and improve overall business performance.