The Role of Cryptocurrency in Cross-Border Payments

The Role of Cryptocurrency in Cross-Border Payments

Introduction

Cryptocurrency has emerged as a groundbreaking technology that has the potential to revolutionize global payment systems. In particular, it has gained traction in cross-border payments, offering faster, cheaper, and more secure transactions compared to traditional methods. In this blog post, we will explore the role of cryptocurrency in cross-border payments and its implications for individuals and businesses alike.

Why Cryptocurrency?

1. Speed and Efficiency

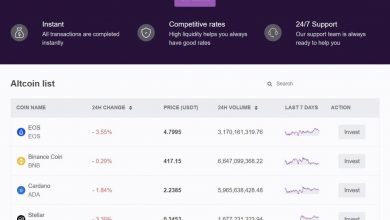

Traditional cross-border payments can take several days to settle due to the involvement of multiple intermediaries and complex verification processes. Cryptocurrency transactions, on the other hand, are executed almost instantly, eliminating the need for intermediaries. This speed and efficiency can greatly benefit businesses that rely on quick payment settlements.

2. Cost Savings

Cross-border transactions often incur high fees imposed by banks, currency conversion charges, and other intermediaries. Cryptocurrency transactions generally have lower fees compared to traditional methods. Moreover, by eliminating intermediaries, cryptocurrencies bypass additional charges associated with their involvement. This cost-saving feature is advantageous for individuals and businesses conducting frequent cross-border transactions.

3. Financial Inclusion

Cryptocurrency allows individuals without access to traditional banking systems to participate in cross-border payments. In many developing countries, a significant portion of the population remains unbanked or underbanked. By utilizing cryptocurrency, these individuals can engage in global trade, access financial services, and improve their economic well-being.

Challenges and Considerations

1. Volatility

One of the primary concerns surrounding cryptocurrency in cross-border payments is its inherent volatility. The value of most cryptocurrencies can fluctuate significantly within short periods. While this volatility can result in potential gains, it can also lead to losses. Businesses and individuals must carefully consider the risks associated with using cryptocurrency for cross-border payments.

2. Regulatory Environment

The regulatory landscape surrounding cryptocurrency is still evolving. Governments around the world are grappling with how to regulate and monitor this new form of digital currency. Wide-scale adoption of cryptocurrency in cross-border payments may necessitate clear regulations to ensure consumer protection, prevent illicit activities, and maintain financial stability.

FAQs

Q1. Are cryptocurrency transactions traceable?

Yes, cryptocurrency transactions are traceable. The blockchain technology underlying cryptocurrencies enables transparency and public accountability. While transactions may not reveal personal identities, transaction details can be traced through the public blockchain ledger.

Q2. Is cryptocurrency widely accepted for cross-border payments?

While the adoption of cryptocurrency for cross-border payments is growing, it is not yet widely accepted. However, various businesses, online merchants, and travel agencies are beginning to recognize the benefits and are starting to accept cryptocurrencies as payment methods.

Q3. Will cryptocurrency replace traditional cross-border payment methods?

Cryptocurrency has the potential to disrupt traditional cross-border payment systems, but it is unlikely to replace them entirely in the near future. The coexistence of cryptocurrencies and traditional methods is more plausible. However, as cryptocurrencies continue to evolve, their role in cross-border payments may expand significantly.

Conclusion

Cryptocurrency is poised to revolutionize the cross-border payments landscape. Its speed, cost-effectiveness, and potential for financial inclusion make it an attractive alternative to traditional payment methods. While challenges such as volatility and regulatory concerns exist, ongoing developments in the cryptocurrency space offer promising prospects for a more seamless, efficient, and inclusive global financial ecosystem. By staying informed, businesses and individuals can navigate the evolving world of cryptocurrency in cross-border payments and leverage its advantages to their benefit.